DraftKings Implementing Winning Bet Tax Surcharge in January 2025

by Robert Linnehan in Sports Betting News

Updated Aug 1, 2024 · 9:17 PM PDT

Sep 12, 2015; Dallas, TX, USA; A general view of the DraftKings sign board during the match with FC Dallas playing against New York City FC at Toyota Stadium. Mandatory Credit: Matthew Emmons-USA TODAY SportsDraftKings announced a new winning bet tax surcharge for four statesThe tax surcharge will go into effect on Jan. 1, 2025It will vary from state to state

DraftKings certainly ruffled some feathers among the betting community during its Q2 earnings report this afternoon.

The sports betting giant announced it will be implementing a “gaming tax surcharge” on winning bets in New York, Illinois, Vermont, and Pennsylvania.

The surcharge will vary from state to state, but was described by DraftKings representatives as “nominal.”

Implementing in States with High Rates

Content:

ToggleThe surcharge will be implemented in “high tax online sports betting states that have multiple operators (Illinois, New York, Pennsylvania, and Vermont) to ensure an operational effective tax rate of approximately 20%,” according to the company’s Q2 earnings report.

New York features an online sports betting tax rate of 51%, Illinois a rate of 20% to 40% depending on the sportsbook’s adjusted gross revenues (likely a 40% rate each month), Pennsylvania a flat rate of 36%, and Vermont a rate of 31% for the operator.

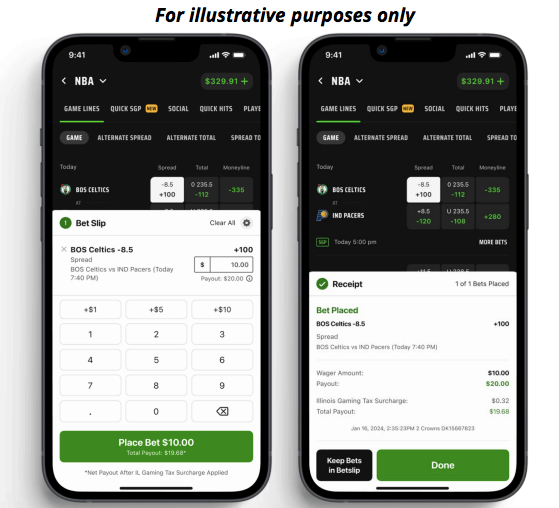

The new surcharge will be implemented in the four states beginning Jan. 1, 2025. While the rate will vary from state to state, in the DraftKings report the company showed a winning +100 odds ticket for $10 in Illinois winning a total of $19.68, instead of the usual $20.

This puts the odds of that ticket at just about -103 with the new surcharge.

The gaming tax surcharge will be clearly identified on each winning ticket, according to the company.

DraftKings Chief Executive Officer and Co-founder Jason Robins touched on the new surcharge in the company’s Q2 press release.

“Additionally, we plan to implement a gaming tax surcharge in high tax states that have multiple mobile sports betting operators on January 1, 2025 which could drive Adjusted EBITDA upside on an annual basis,” he said.

Will Tax Move Into Other DK States?

The new surcharge on winning bets was met with consternation from sport bettors.

“If you bet in IL, NY, PA, or VT get a load of this. DraftKings will be adding a SURCHARGE to be subtracted from YOUR net winnings to pay for THEIR TAX on gambling revenue. The money they make from losing bettors. Wow. Just wow,” Captain Jack Andrews (not his real name), professional sports bettor and co-founder of Unabated, posted on social media platform X.

It will be interesting to see if DraftKing implements the new surcharge elsewhere. Massachusetts and Ohio both have 20% tax rates, the next most expensive rate in states where DraftKings operators, and would likely be the next target for the company if the tax is expanded.

Could this also be a new tool for operators to use to combat what they perceive as high tax rates? If the new surcharge on winning bets doesn’t seriously impact DraftKings’ business, it’s not unfair to think other operators such as FanDuel, Caesars Sportsbook, or ESPN BET would consider implementing their own as well.

On the other side, it could also be used as an incentive to gain users by these other operators if they do not implement surcharges on winning bets. It could be a point of differentiation that operators use to potentially close the gap with DraftKings across the U.S. sports betting markets.